how does hawaii tax capital gains

If you make 70000 a year living in the region of Hawaii USA you will be taxed 14386. The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96.

If the collected amount is too large how do you obtain a refund.

. Uppermost capital gains tax rates by state 2015 State State uppermost rate. Your average tax rate is 1198 and your marginal tax rate is. How does Hawaiis tax code compare.

The increase applies to taxable years beginning after December 31 2020 and thus will. DTAX Message 0201doc Author. The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring states in 2015.

States That Tax Capital Gains. Long-term capital gains tax can impact you if you sell any capital assets and earn a profit on those. Hawaii has a graduated individual income tax with rates ranging from 140 percent.

Tax Law and Guidance Hawaii Taxpayers Bill of Rights PDF 2 pages 405 KB Revised July 2022 Tax Brochures Tax Law and Rules Tax Information Releases TIRs. 1 increases the Hawaii income tax rate on capital gains from 725 to 9. The difference between how much is withheld and.

If the 725 of sales price withholding is too large the. Hawaii Income Tax Calculator 2021. The Hawaii capital gains tax on real estate is 725.

This applies to all four factors of gain refer below for a discussion of the four factors. The Hawaii capital gains tax on real estate is 725. The federal government taxes income generated by wealth such as capital gains at lower rates than wages and.

Gain is determined largely by appreciation how much more valuable a property is. Under current law a 44 tax rate is imposed on taxable income less. Some States Have Tax Preferences for Capital Gains.

A majority of US. The rates listed below are for 2022 which are taxes. The 2022 state personal income tax brackets are.

That applies to both long- and short-term capital gains. In Hawaii long-term capital gains are taxed at a maximum rate of. Income tax rate schedules vary from 14 to 825 based on taxable income and filing status.

Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. Individual Income Tax Chapter 235 On net incomes of individual taxpayers. Taxes in Hawaii Hawaii Tax Rates Collections and Burdens.

Hawaiis capital gains tax rate is 725. What is the actual Hawaii capital gains tax. Hawaii taxes gain realized on the sale of real estate at 725.

States have an additional capital gains tax rate between 29 and 133. For instance if you sell a house you bought ten years ago any gains you make.

The Worst States For Taxes Travel Nursing Pay Tax Deductions Tax Services

6 Financial Moves To Make When The Market Goes Down Kiplinger Obama Capital Gains Tax Saving For Retirement

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

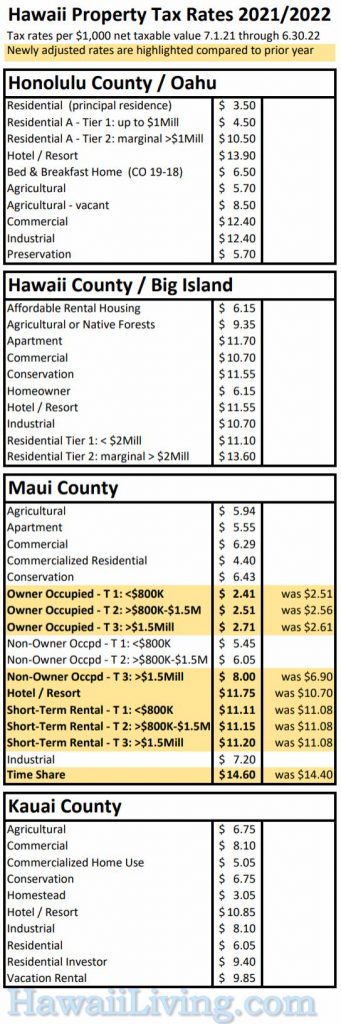

New Hawaii Property Tax Rates 2021 2022

State Taxes On Capital Gains Center On Budget And Policy Priorities

5 Year Study Finds Bitcoin Is A Way Better Investment Than Real Estate Capital Gains Tax Investing Best Investments

Real Estate Or Bonds Which Is A Better Investment Investing Corporate Bonds Bond Funds

Pin By Kimberlee Erickson Daugherty On Financial Freedom Investing Understanding Things To Think About

The Way Things Were Income Tax Return Income Tax Tax Return

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

It S Time To Close Hawaii S Capital Gains Tax Loophole Hawaiʻi Tax Fairness Coalition

Sf Ny Tokyo Housing Prices Adam Tooze Real Estate Tips Graphing House Prices

Oceanfront Maui Estate Perched Along A Turtle Filled Cove Seeks 8 75 Million In 2022 Oceanfront Estates Hawaii Life

Do You Know The Cost Of Waiting Infographic Keeping Current Matters Real Estate Advice Real Estate Infographic Selling Real Estate

Property Investment Returns Are They Worth The Effort Wealthy Healthy Life Investing Investment Property Buying Investment Property